How do you compare? 5 traits of

financially prepared veterans

Veterans are a highly diverse group of people—from their military background to their civilian career, from their education to their household income, from their age to their marital status. A new study found that veterans who are on-track or ahead in meeting their financial goals cut across these demographics, and they also hold 5 attributes in common.

The Veterans Financial Preparedness Report 2019 is the very first study to examine how well-equipped U.S. military veterans are to meet their financial goals after leaving the military. Prepared by the Legionnaire Insurance Trust for the departments of the American Legion in honor of the Legion’s 100th anniversary, the study includes key findings from a survey of more than 1,500 veterans, representing a wide variety of backgrounds.

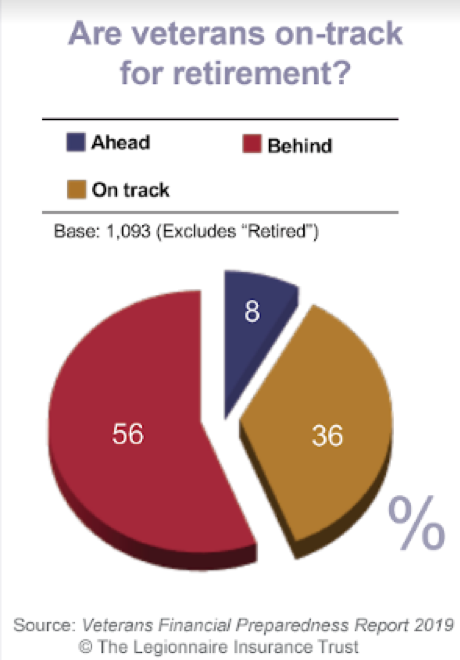

Overall, more than one-half of veterans said they are behind on saving for retirement, while just over one-third said they are on-track and just 8% said they are ahead of schedule.

Which veterans are financially prepared

Given that so many veterans are behind in saving, what sets apart those who are on-track and ahead of schedule from their peers? According to the report, 5 attributes were common among these veterans:

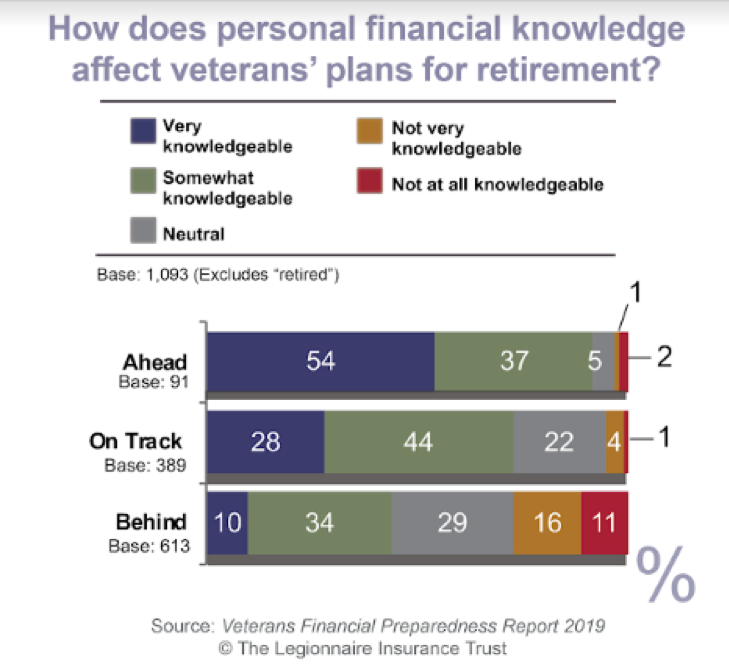

1. They are knowledgeable about personal finances

Personal financial issues may not be an area of interest or expertise for you, but doing your research and becoming educated on topics such as retirement planning, investments and insurance can be an important element of financial preparedness.

Most veterans who are ahead or on-track say they are knowledgeable about personal finances, while those who are behind are much more likely to say they do not consider themselves knowledgeable.

2. They started saving early

Veterans who started saving early were more likely to be in a strong financial position, according to the report. While 38% of those who say they are behind haven’t started saving for retirement yet, 60% of veterans who are ahead and 34% of those who are on-track started saving immediately after high school or within the first 2 years of joining the military.

>>More in the report: Certain age groups were more likely to start saving early. Read the report to find out which veterans follow this trend and to discover the mean portfolio values of veterans.

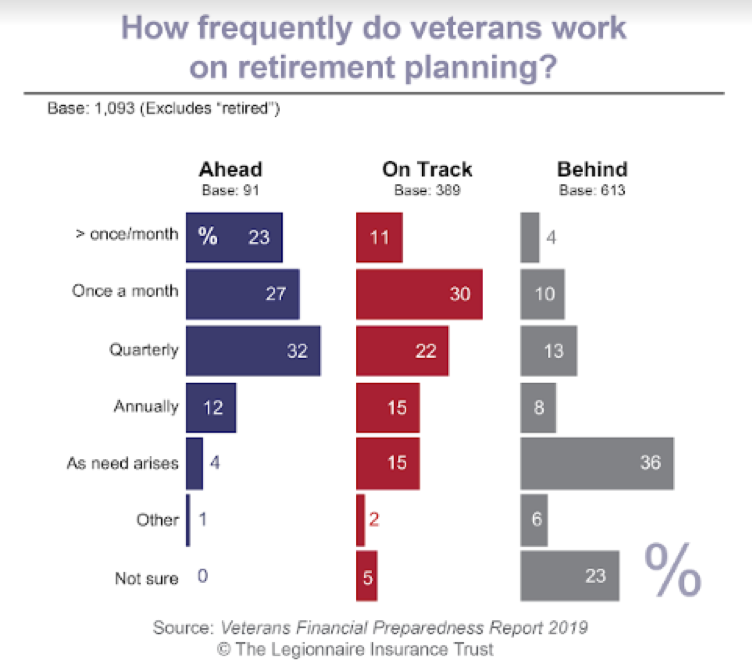

3. They understand the importance of planning for the future

For financially prepared veterans, retirement planning is a continuous process. While those who are behind tend to only address their personal financial plans as the need arises, the vast majority of veterans who are ahead or on-track work on their retirement planning on a quarterly basis at minimum.

4. They work with a professional financial advisor for expert advice

Partnering with a professional financial advisor is another important aspect of veterans’ financial preparedness success. Three-quarters of veterans who are ahead of schedule and nearly one-half of those who are on-track work with an advisor, compared to just 13% of those who are behind.

The vast majority of veterans who work with an advisor say they are satisfied with them and that they are confident they are making the best financial decisions for their family.

5. They protect their family with an emergency fund and life insurance

Alongside diligent saving and planning, veterans who are financially prepared also maintain an emergency fund and invest in life insurance to safeguard the nest eggs they have built.

93% of veterans who are ahead have an emergency fund, as do 75% of those who are on-track. In comparison, only 32% of veterans who are behind have an emergency fund.

Similarly, 75% of those who are ahead have life insurance, compared to just 44% of veterans who are behind. Those with life insurance are more likely to be confident they are making the best financial decisions for their family.

>>More in the report: How much do veterans keep in their emergency funds? Read the report to learn more.

5 attributes, 1 mindset At the heart of these 5 attributes of financially prepared veterans is a single mindset of personal responsibility. Not surprisingly, those who took the principles that made their military service successful and carried them through to their personal finances tend to be in a stronger financial position.

Veterans who take charge of their finances through personal education, saving early and working with a financial advisor are confident about their family’s financial future.

Learn more about what you can do to strengthen your financial position by reading the Veterans Financial Preparedness Report 2019. It offers key findings, practical benchmarks, advice from veterans who have been in your shoes and insights from a financial professional who has served in the military.

Read Articles

• How do you compare? 5 traits of financially prepared veterans

• Veterans share 6 top insights for financial preparedness

• Transitions: The key moments for veteran’s financial health

• Behind for retirement? How veterans can get on-track (Part 1)

• Behind for retirement? How veterans can get on-track (Part 2)