Veterans share 6 top insights for financial preparedness

1,507 U.S. military veterans recently offered their best advice for active-duty service members and veteran families regarding personal financial decisions. The survey was conducted for the newly released Veterans Financial Preparedness Report 2019, prepared by the Legionnaire Insurance Trust for the departments of The American Legion in celebration of the Legion’s 100th anniversary.

A mantra of saving

The overwhelmingly most common advice veterans shared was, “Save, save, save!” The importance of saving to financial health and preparedness can’t be underscored enough, but what does this mean in the context of veterans’ daily lives? Many veterans gave insights in their top advice.

1. Start saving from Day One, paying yourself first.

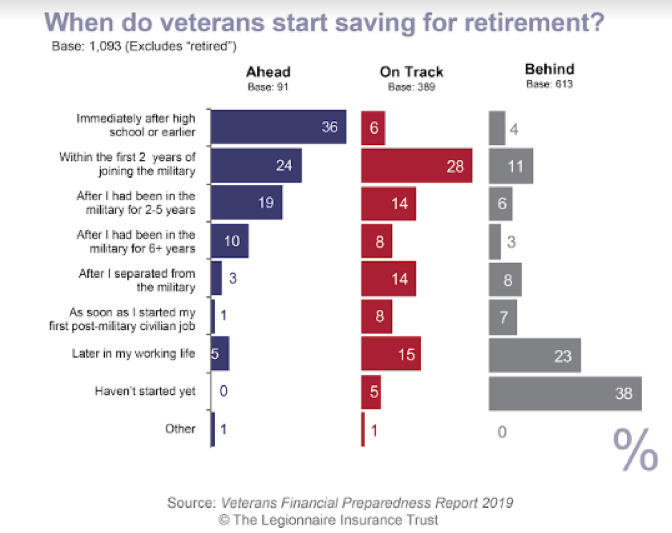

Veterans who start saving early are more likely to be in a strong financial position, according to the Veterans Financial Preparedness Report 2019. In fact, the report found that 60% of veterans who say they are ahead in their financial plans for retirement started saving immediately after high school or within the first 2 years of joining the military.

In their advice, these veterans comment that it’s not always easy to save, but it is well worth it in the long run:

• “Start when it’s still uncomfortable—you won’t regret it later.”

• “If you wait, chances are you’ll wait too long.”

• “Even $10 [could] be worth hundreds by the time you retire because of compounding.”

• “You will always feel you are not making enough. Do not let that keep you from saving.”

• “Pay yourself first.”

• “Focus on saving as much as possible with each check—almost like it’s a car payment or a requirement.”

2. Save as much as possible.

The more you can save, especially early on, the better financially prepared you will be. That can mean making sacrifices to ensure you’re saving enough.

• “Beginning today, start putting money aside for your retirement years, and have it reviewed at least once per year. As your monthly paycheck goes up, so should your contributions to your own retirement.”

• “Save until it hurts. Be soldier-minded in regards to how you save—be minimalists like a soldier. Then afterward, you’ve achieved a seemingly impossible number.”

• “Start your Thrift Saving Plan (TSP) immediately, and put the maximum amount you can in.”

• “If you have a 401k, match what the company vests.”

3. Don’t spend money on things you don’t need.

Veterans emphasize the importance of discipline in spending. Prioritizing your true needs and savings over things you would like to have is a key part of that.

• “Evaluate need versus want when buying expensive items.”

• “Save every penny you can. Material things are not important. Expensive cars, clothes and other things are not important. Saving for your future is important!”

• “Don’t get into debt. There’s a big difference between want and need. The mistakes you make financially will follow you for decades.”

4. Live within your means, avoiding debt.

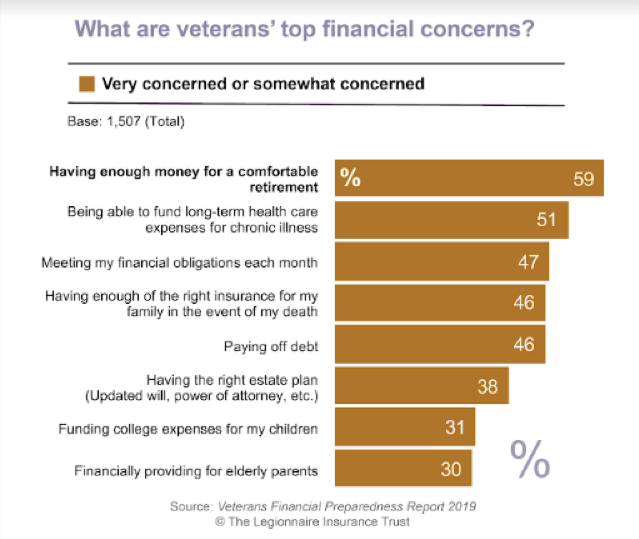

In addition to having enough money for retirement, veterans’ top financial concerns included more immediate financial needs, such as meeting financial obligations each month and paying off debt, according to the Legionnaire Insurance Trust report.

Veterans offered a number of recommendations for tackling these concerns, including:

• “Follow the rule that unless it’s an emergency, if you can’t pay cash, then you can’t buy it.”

• “Set a budget and communicate with your spouse. Talk about money—don’t ignore it.”

• “If you don’t have a way to pay for something, don’t buy it (discipline).”

• “No matter how much money you make, still make it a point to make that amount stretch as much as you can paycheck to paycheck.”

5. Start planning for retirement early.

Looking ahead and working from a concrete financial plan unique to your circumstances and goals is another key piece of advice from veterans.

• “Don’t wait to start planning for the future. The earlier you start saving and thinking ahead, the better prepared you’ll be.”

• “Write down your financial goals: short-term, medium-term and long-term.”

• “Stick to your plans and goals.”

• “Talk to other members and advisors about retirement early.”

6. Educate yourself.

A key component to successfully planning and saving that many veterans highlighted is making sure to build your knowledge of personal financial issues. The report found a strong tie between financial preparedness and knowledge: 91% of veterans who are ahead of schedule for retirement consider themselves knowledgeable about personal finances, while 75% of veterans who are behind say they are not knowledgeable.

• “Use any and every opportunity and resource you can access or utilize.”

• “Do your homework, and research every decision you make so you know exactly what you’re getting into.”

• “Listen to and learn from every military pension presentation. So much value is given that I learned from them and continue to use what I learned.”

• “Take advantage of classes that will prepare you financially for your time in the service and for when you are discharged. Learn about organizations that can help current and former military persons.”

Discover more insights from veterans

The Veterans Financial Preparedness Report 2019 features additional advice from the 1,507 veteran respondents as well as insights from a Certified Financial Planner™ with 16 years of military service, including three deployments. The report includes key findings about veterans’ financial situations and shares 5 attributes of veterans who are financially prepared.

Read Articles

• How do you compare? 5 traits of financially prepared veterans

• Veterans share 6 top insights for financial preparedness

• Transitions: The key moments for veteran’s financial health

• Behind for retirement? How veterans can get on-track (Part 1)

• Behind for retirement? How veterans can get on-track (Part 2)